There are many factors that impact real estate prices, but ultimately, it comes down to liquidity and ease of access to attain funds. Money for down payments used to come from savings and income, but since the late ’80s, banks started extending more and more credit which largely affects the flow of real estate today. That’s why we’ve taken some information from a recently published article by Better Dwelling to help give some insight on the credit cycle and its impact on real estate markets.

Credit Cycles 101

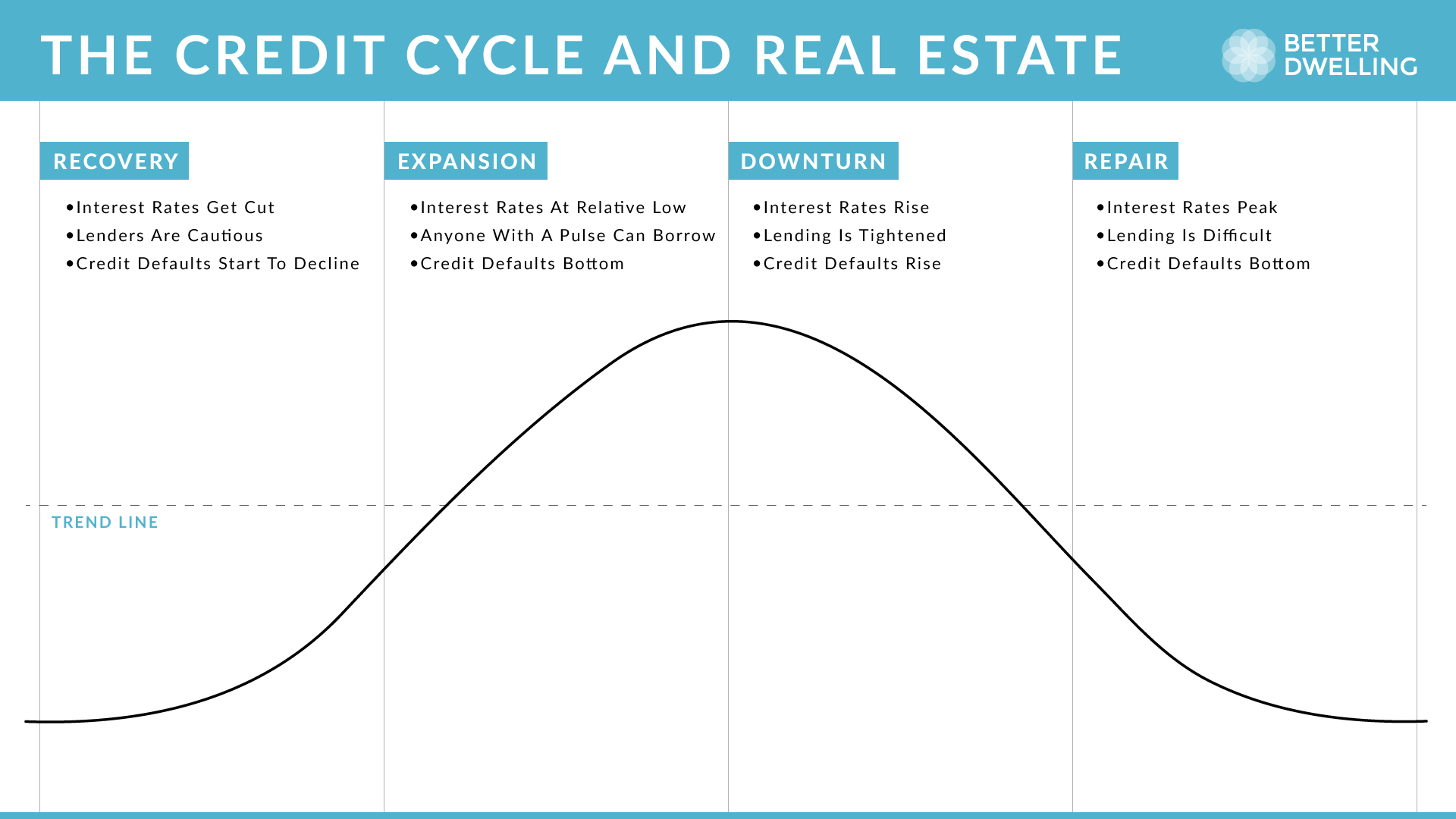

The credit cycle is broken down in 4 equally important phases – recovery, expansion, downturn, and repair. The cycle is based on availability of credit, and the expansion and contractions it makes. Credit availability and income are major factors of home buying, which is why the credit cycle plays a pretty large role in determining real estate prices and the course of the market.

Source: BetterDwelling.com

The Expansion Phase

The credit expansion phase is when credit expands very quickly. A phase we’ve all become familiar with in recent years. Have you ever heard that a loan is easiest to get when you don’t need one? That’s what’s happening in this phase, but with whole economies. Wages grow, unemployment falls, and credit defaults print new lows. The increased wealth from the employment boom meets low rates to create a lot of leverage – and fast. During this phase, debt rapidly expands, but it’s fine – the job market is booming and banks willingly hand out loans to nearly anyone. Asset prices like stocks and real estate make very sharp climbs.

The Downturn

Sadly, too much of a good thing can be hard to maintain and it's the downturn phase that the British Columbia real estate market is starting to experience. In the beginning of this transitional phase, credit growth trends lower and stabilize at a lower rate. Debt is still growing, but much less than it was just a year before. Defaults start to gently climb and assets start to lose luster.

The slowing of credit growth adds up towards the end of this phase. The economy grew so quickly during the expansion, everyone's forecasts of huge growth can’t be met, which leads to interest rate hikes which we saw in late 2017, a sudden halt in spending, and rise in unemployment. Credit starts to tighten as lenders carefully choose new borrowers. The end of the phase is usually marked by a recession and falling asset prices which many of us are currently trying to predict the severity of.

The Repair

No, the doom doesn’t last forever. The economy just needs to tweak its inefficiencies caused during expansion. During the repair phase, the reallocation begins. Household debt decreases, unemployment begins to drop, and credit defaults start to bottom. Interest rates are about as high as they can get, and may start getting cut. Asset prices start to make a gentle climb back higher.

The Recovery Phase

During this phase, credit and asset growth is relatively flat and damage from previous cycles is being repaired. Defaults and unemployment peak, and things start to feel normal. Interest rates are cut to “stimulate” the economy, and household debt starts growing again. The impact is increased liquidity, which allows asset prices to grow, which makes it easier for banks to lend.

Rinse and repeat, for as long as people will over and underestimate expectations. Properly assessing risk is how you make and keep wealth. There can’t always be a right time to buy and sell every asset. Asking for advice and doing some research are great places to start when dealing with a fluctuating market. Managing your assets on your own terms is the best thing as you never want to be in a position where you're forced to make decisions based on market conditions.

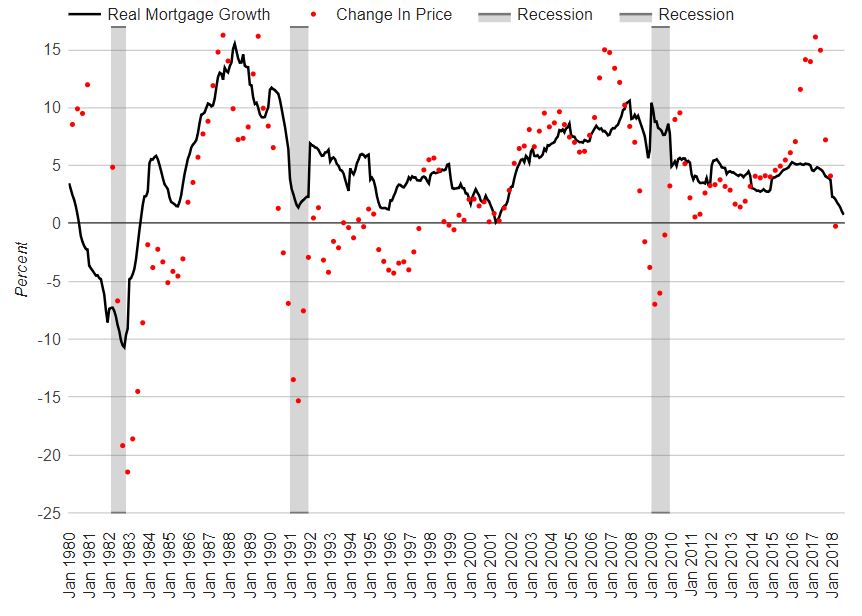

Canadian Real Mortgage Credit Growth

The annual percent change in mortgage credit growth, adjusted for inflation. Real Canadian home prices are plot as annual change per quarter, for reference.