After the perfect storm for a market correction unfolded in 2018, some much needed positive news in 2019 has generated cautious optimism in the real estate market. Here’s our take on the current state of the market from a development land perspective.

cause and effect

Through the first few months of the year, total land transactions were 40% below the 10 year average. This indicated developers had grown uncertain of market conditions and put future land acquisitions on hold as they gauge future demand. The once white hot presale market has cooled to multi decade lows, leading developers to not only pause land acquisitions but in some cases even pause entire projects as they wait for more favorable conditions.

What caused this slump in the first place? We’ve compiled a list of factors which we believe were catalysts in slowing the real estate market in 2018 and early 2019.

- New Provincial Taxes

(vacancy tax, foreign buyers tax, additional school tax for properties valued at more than $3 million) - Stress Test applied to all purchases, insured or uninsured

- Five 0.25% interest rate hikes

- Global trade uncertainty

- Crack down on foreign ownership/money laundering

LOOKING UP!

Not all is negative though as sales figures for May, June and July have surpassed industry estimates. Future development properties that are well located, contain some level of certainty and are well priced have continued to sell well and near peak prices. We believe this small but notable increase in optimism for the remainder of 2019 was brought on by a combination of the factors below. Although some of these events are hardly real estate related, they play into the overall health of the economy, a prerequisite for a healthy and bourgeoning real estate market.

- Stalling of interest rate hikes due to slumping oil prices, slowing real estate market and decreased consumer spending

- Upcoming Federal election, where promises are often made to pitch housing affordability

- Interest rate reduction by the Fed in the United States which often pressures the Bank of Canada to follow

- Easing of stress test by 0.15% in mid-July

- Easing of trade tensions globally

- Pent up demand from buyers that were put on the sidelines due to stress test

- Approval of Langley-Surrey SkyTrain

- Approval of Trans Mountain Pipeline

While none of the above factors can quickly reverse the dramatic real estate slowdown kick started in early 2018, all are welcome news for an economy so reliant on real estate and its benefitting industries such as construction, banking, etc.

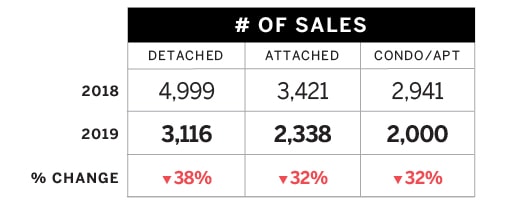

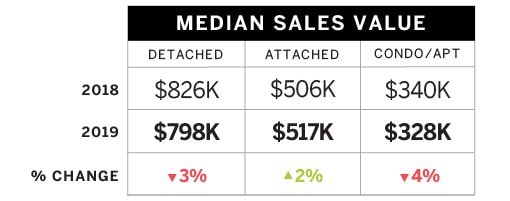

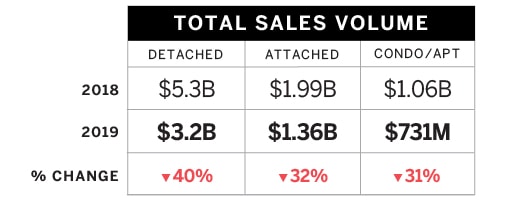

For further context and perspective, we’ve partnered with Jeff Tisdale of Landcor Data Corporation to compile sales data for January to May of 2019 in comparison to the same period in 2018.

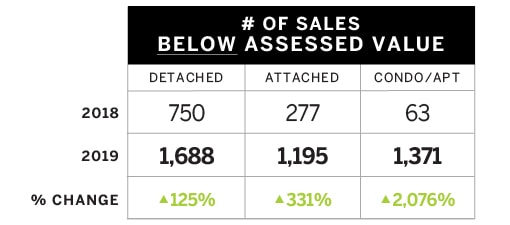

Jeff provided sales data as well as looked at the sales in relation to assessment values and their pronounced shift from selling above assessed value in 2018 to almost exclusively below assessed value this year. This notable shift is most likely due to the assessments lagging true market conditions, having been calculated in the first half of 2018 when conditions were different to say the least. Although BC Assessment values are not a huge deciding factor for market prices in development land, the numbers help illustrate changing market sentiment.

Jan - MAY 2018 vs 2019assessment and sales summary

DATA REPRESENTS:Abbotsford, Chilliwack, Langley, Maple Ridge, Mission, Surrey

Much like the cover of our 2019 annual Varing Magazine, which featured a bear and a bull going head to head, the market’s direction is still unclear. The latest sales figures seem to indicate we’re in for much more of the same for the remainder of 2019 with a possible slight increase in transaction numbers.

Regardless of market sentiment, we’ve continued to work alongside land owners to help them maximize their properties values. Check out a few of our notable sales during the first half of 2019.

Data from Landcor.com. Email [email protected] for more market trends and property analytics.

Jeff Tisdale / CEO of Landcor Data Corp.

Established in 1988, Landcor Data Corp. is a leading provider of Financial Services and Real Estate solutions that enable fast, accurate and unbiased valuation and analysis of properties throughout the province of British Columbia. Landcor maintains the best source of real estate data and analytic tools available.

Visit Landcor.com or email [email protected] for more market trends and property analytics.

For clarification on any of the above topics or to discuss them more in detail, please reach out to us at [email protected] or by phone at 604.565.3478

Share your thoughts.